COMMITTED TO MAKING A DIFFERENCE TO YOUR BUSINESS AND LIFE

Reg Aung Thein • March 4, 2018

At Crofts, everything we do is based on one important thing: Supporting your Success.

To consistently deliver the outcomes you expect, we need to actively work to make that happen. So we decided to make a clear and visible statement of what we believe in, what we do and its value to you.

You'll see the difference in many ways: from team-based support to grow your business, to new technologies that make doing business simpler and easier. The Crofts logo and visual identity has also been refreshed to match our energy and intent.

What won't change is the commitment and care for your business and success. The team and I are looking forward to taking you through how we can make a tangible difference in ways that really count.

Reg.

Put Clients First and Share Opportunity: Crofts' new Associate Directors typify what drives our culture. When asked to describe the newly appointed Associate Directors at Crofts, Managing Director Reg Aung Thein said, "Above all else, they are both really good human beings. They personify what Crofts is about: caring for clients, each other and our business." In his eight years at Crofts, Khusheev Singh has embraced the Crofts ethos. "Starting out in accounting, the expectation was to be purely professional and transactional in my communication and conduct with clients. But after coming to Crofts it clicked that clients are people with aspirations and needs; and the relationship changed to being more like an advisor or friend to them. Now I offer advice based on what I know matters to our clients, and because I want them to succeed". This mindset starts at the top, according to fellow Associate Director Fabio Carrillo. "Reg cares about everyone in this organisation- whether they're clients, colleagues or employees. He is really responsible for fostering our work environment and culture." Fabio has worked for other firms where it's been about growth and looking after yourself. "At Crofts, we're all on the same page, we trust each other and celebrate each other's success."

Dear Friends, Following on from our previous COVID-19 updates, we would like to provide you with a brief update in relation to the Federal Government's proposed JobKeeper Payment that has been announced. The JobKeeper Payment is designed to help businesses affected by the Coronavirus to cover the costs of their employees' wages, so that more employees can retain their job and continue to earn an income. It is also available to self-employed individuals. The scheme will see the Australian Government pay employers a wage subsidy at a flat rate of $1,500 per eligible employee per fortnight, for up to six months, commencing on 30 March 2020. That said, the subsidy will be paid monthly in arrears with the first payment commencing in the first week of May 2020. Eligible Employers: Businesses who employ staff will be eligible for the subsidy if: For businesses with turnover of less than $1 billion who experience, or expect to experience, at least a 30% reduction in revenue in any month since 1 March, versus the same month the year prior. For businesses with turnover of more than $1 billion will require the a 50% reduction in revenue on the same basis. Self-employed individuals and not-for-profit entities that satisfy the appropriate above eligibility conditions will also be eligible to apply for the JobKeeper Payment. Eligible Employees Eligible employees must have been employed by the business on 1 March 2020, and continue to be engaged by the employer. Employees include Full-time, Part-time, and Long-term Casuals (employed regularly for the past 12 months). Stood down employees who are re-hired are also eligible. Employees must be an Australian citizen, the holder of a permanent visa, a Protected Special Category Visa Holder, a non-protected Special Category Visa Holder who has been residing continually in Australia for 10 years or more, or a Special Category (Subclass 444) Visa Holder. Where employees have multiple employers, only the primary employer will be eligible to receive the payment. If an employee ordinarily receives less than $1,500 in income per fortnight before tax, under this scheme the employer must top up that employee's income to $1,500 per fortnight, before tax. (i.e. pass on the full effect of the subsidy to the employee). An eligible employer receiving the JobKeeper Payment in respect of one or more employees will be required to notify each employee that they have been nominated as eligible employees for the employer to receive the payment. Employers must apply to the Australian Taxation Office (ATO) to participate in the scheme and provide supporting information, demonstrating the impact felt in their business. Employers will also need to continue to report to the ATO the number of eligible employees employed by their business each month, which is expected to be data-matched against reported Single Touch Payroll information. Employers can register their interest in the scheme here: https://www.ato.gov.au/Job-keeper-payment/ We will pro v ide further details in relation to this once these proposals are legislated. Remember, we are here to help and please don't hesitate to contact me or any of our team members if you have any questions or concerns. We will continue to keep you updated if there are any changes. Take care of your family and be safe.

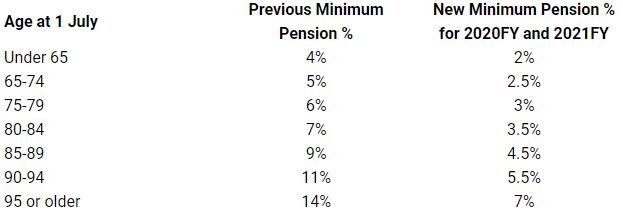

Dear Friends, As the Government has introduced new directives regarding COVID-19, we wanted to provide you with an update on Crofts and assure you that we are ever more committed to looking after you during the unfamiliar and challenging times ahead. As of today, the majority of our staff will be working from home, with the exception of a very small number of key staff to remain in the office. We are confident that disruptions to our services will be minimal. Our main phone line will be diverted to a single external line. We ask for your patience at this time and if there is a busy signal please call again soon after. We will ensure that the team member you are calling for will call you back promptly. Alternatively, feel free to send one of our team members an email to get in contact with you. If you are unsure of their email address please send the email on to admin@crofts.com.au In a ddition, as per our earlier communications, as of 24 March 2020, the government has legislated a number of measures to assist businesses and others during this period. The following is a broad summary of the key aspects of the Federal Government's stimulus package. We will aim to keep you informed on how these measures will affect you and your business. If you have any queries on your entitlement to these measures and how these measures are to operate practically, or require any more information please don't hesitate to contact us. MEASURES FOR BUSINESSES Cash Flow Boost Payments Businesses that employ staff, have had an ABN from prior to 12 March 2020, and have an aggregated annual turnover of less than $50 million will receive a tax-free payment of up to $100,000. These payments will be staged over a period covering the March 2020 to September 2020 activity statement lodgements and will be calculated based on the PAYG withholding obligations of the business as declared on these activity statements. Provided the business meets all other eligibility criteria and has paid salaries, wages or directors fees (or any other such amounts) on any of the relevant activity statements from March 2020 to June 2020, the business will be entitled to a minimum total payment of $20,000, increasing based upon the PAYGW obligations declared. It should be noted that eligibility for the above payments is subject to a specific integrity rule that is designed to stamp out artificial or contrived arrangements that are implemented to obtain access to this measure. Wages Subsidies for Apprentices and Trainees Employers with less than 20 full-time employees will be entitled to a wage subsidy of 50% of an apprentice or trainee's wage from 1 January to 30 September 2020, capped at $21,000 per apprentice. Instant Asset Write-off The instant asset write-off threshold is increased from $30,000 to $150,000 and access is expanded to include businesses with an aggregated annual turnover below $500m (up from $50m). This measure applies from 12 March 2020 to 30 June 2020 to new or second-hand assets first used, or installed to be ready for use in this timeframe. Accelerated Depreciation Businesses with an aggregated turnover below $500m will be able to deduct 50% of the cost of an eligible asset on installation, with existing depreciation rules applying to the balance of the asset's cost. The measure applies from 12 March 2020 to 30 June 2021 to new assets that can be depreciated. Where a small business entity is using the pooling methods available under the simplified depreciation rules, the entity may deduct an amount equal to 57.5% of the asset cost in the year it is allocated to the pool (rather than 15%). State Payroll Tax Concessions NSW For employers who lodge and pay monthly payroll tax and whose total Australian wages will be no more than $10 million for the current financial year, no payment is required for the months of March 2020, April 2020 or May 2020. When lodging their annual reconciliation, employers will still need to provide wage details paid in these months and will receive the benefit of a 25% reduction in the amount of tax that they would have had to pay for the 2020 financial year. Also, the payroll tax threshold will be increased to $1 million from 1 July 2020. QLD Relief can be applied for to defer due dates for payroll tax payments to 3 August 2020. VIC For employers whose total Victorian wages are less than $3 million for the 2020 financial year, a full payroll tax refund will be available for the 2020 financial year. Eligible businesses must continue to lodge returns but do not need to make further payments for this financial year. Payment of the payroll tax for the first quarter of the 2021 financial year may also be deferred to January 2021 for employers that meet this wage limit. WA Employers paying less than $7.5 million in total Australian wages that are effected by COVID-19 can apply to defer payments for 2020 payroll tax to 21 July 2020. A grant of $17,500 will be automatically paid to employers (only one per group) in July 2020 if annual Australian wages are between $1 million and $4 million. Also, the payroll tax threshold will be increased to $1 million from 1 July 2020. ACT Employers in the hospitality industry can apply to have their payroll tax liabilities for the months from April 2020 to September 2020 waived. Employers with less than $10 million total Australian wages can also apply to defer their 2020-2021 payroll tax payments to 1 July 2022 interest free. TAS For employers in the hospitality, tourism and seafood industries, no payment is required for the months of March 2020, April 2020 or May 2020. When lodging their annual reconciliation, employers will receive a waiver of payroll tax for the relevant wages paid in these months and in June 2020. Other employers whose total Australian wages will be no more than $5 million for the current financial year may also apply for this concession if they are effected by COVID-19. There may also be a rebate available for employers paying payroll tax who employ new youth employees from 1 April 2020. NT No payroll tax measures have been announced to date. SA No payroll tax measures have been announced to date. MEASURES FOR INDIVIDUALS Early Release of Super Individuals that are unemployed, receive certain benefits, or have been made redundant or suffered a large reduction in working hours on or after 1 January 2020 may be entitled to release up to $10,000 of their superannuation before 1 July 2020 and a further $10,000 from 1 July 2020 until 24 September 2020. Income Supplement and Assistance payments A new Coronavirus supplement of $550 per fortnight will be paid for a 6 month period from 27 April 2020 to individuals who are currently eligible for certain income support payments. For the period that the Coronavirus supplement is paid, the Government will also expand access to certain income support payments. The Government will be providing two separate $750 tax-free payments (referred to as economic support payments) to social security, veteran and other income support recipients and to eligible concession card holders. The first payment will be made from 31 March 2020 and the second payment will be made from 13 July 2020, however, the second payment will not be made to anyone in receipt of the Coronavirus Supplement noted above. Temporary Reduction of Minimum Superannuation Drawdown Rates Minimum pension drawdowns will be reduced by 50% for the 2020 & the 2021 financial years. This measure allows members receiving a pension to remain in a tax free pension environment whilst maintaining a higher balance. Please see the below table for what rate will be applied to your pension member balance on 1 July to calculate the minimum pension drawdown for the 2020 & 2021 financial years. No changes have been made to the maximum pension drawdowns.

Dear Friends, Whilst the below message is giving you reassurance for business as usual from our end, we have not forgotten the human aspect of the current circumstances and the different level of emotional impact it is having on everyone. To that end, we are all in this together and if you need to talk to myself or anyone at Crofts, we are only a phone call away. Crofts Chartered Accountants wishes to inform our clients about its readiness to continue to provide services in light of the evolving situation around COVID-19. Internal processes are now in place, as we are committed to providing a safe and healthy working environment for all our employees and are proactively working with our clients to identify potential risks of any nature and how to best mitigate them. We are continually communicating with our staff and will continue to update them on changes as issued by the Australian Government Department of Health over the coming weeks. We appreciate that our staff are exercising appropriate and proactive caution around hygiene practices and limiting their domestic and international travel. In the event of our office being required to close, we have a contingency plan in place. Rather than hosting physical meetings, we are replacing them with other digital modes of communications, such as video and phone calls, in order to prevent any possible COVID-19 transmissions. All our staff have been issued with laptops for remote working to ensure your complete business continuity. Since last week some of our staff have already put this into practice, where they have proactively stayed home and worked from home when they are experiencing any symptoms of a cold or a flu. Currently we believe disruptions to our services will be minimal. Careful consideration has gone into the decisions we have made to date and detailed risk assessments are in place. If required, we have further measures to update and support current working employees, however, we are monitoring the situation daily and following government advice on the matter. We will keep you will informed, and will notify you of any changes in our daily operations should they arise, as per Government and Health Department recommendations. It is crucial we work together during this unusual time, so thank you for your ongoing support. Coronavirus Stimulus Package The government's economic response to the coronavirus (COVID-19) outbreak contains temporary tax measures to support business investment, including increasing and extending the instant asset write-off and accelerating depreciation deductions, as well as the ATO providing administrative relief. The measures form part of the government's economic response totalling $17.6b (or 0.9% of annual GDP) to address four key areas including: Cash flow assistance cash flow assistance for employers, including: boosting cash flow for employers : providing employers with an aggregated annual turnover below $50m a tax-free payment equal to 50% of Pay As You Go (PAYG) amounts withheld, with a minimum payment of $2,000 and a cap of $25,000 to be delivered as a credit upon lodgment of the employer's activity statements with the ATO from 28 April 2020. Eligible businesses that pay salary and wages will receive a $2,000 minimum payment even if they are not required to withhold tax. The ATO will refund monies if this measure places the business in a refund position, and apprentice and trainee wage subsidy : providing eligible small businesses a wage subsidy of 50% of an apprentice or trainee's wage from 1 January to 30 September 2020, capped at $21,000 a one-off stimulus payment of $750 to social security, veteran and other income support recipients and eligible concession card holders, and assistance for severely affected regions and communities (including ATO administrative relief discussed below). Tax measures to support business investment The government announced the following two temporary measures to support business investment. Increasing the instant asset write-off : the instant asset write-off threshold is increased from $30,000 to $150,000 and access is expanded to include businesses with an aggregated annual turnover below $500m (up from $50m). This measure applies from 12 March 2020 to 30 June 2020 to new or second-hand assets first used, or installed to be ready for use in this timeframe. A 15-month investment incentive to accelerate depreciation deductions : businesses with an aggregated turnover below $500m will be able to deduct 50% of the cost of an eligible asset on installation, with existing depreciation (or capital allowance) rules applying to the balance of the asset's cost. The measure applies from 12 March 2020 to 30 June 2021 to new assets that can be depreciated under Div 40 of ITAA 1997 (ie plant, equipment and specified intangible assets, such as patents). It does not apply to second-hand Div 40 assets, or buildings and other capital works depreciable under Div 43 of ITAA 1997. The Government will move quickly to implement this package. To that end, a package of Bills will be introduced into Parliament in the final Autumn sitting week in March 2020 for Parliament's urgent consideration and passage. Following passage of the Bills through Parliament, the Government will then move to immediately make, and register, any supporting instruments. ATO administrative relief The ATO will provide administrative relief for some tax obligations for people affected by the coronavirus outbreak, on a case-by-case basis. Businesses impacted by the coronavirus should contact the ATO to discuss relief options. Options include: deferring by up to four months the payment date of amounts due through the business activity statements (BAS, including PAYG instalments), income tax assessments, FBT assessments and excise allowing businesses on a quarterly reporting cycle to opt into monthly GST reporting in order to get quicker access to GST refunds they may be entitled to allowing businesses to vary PAYG instalment amounts to zero for the Mar 2020 quarter; businesses that vary their PAYG instalment to zero can also claim a refund for any instalments made for the September 2019 and December 2019 quarters remitting any interest and penalties, incurred on or after 23 January 2020, that have been applied to tax liabilities, and working with affected businesses to help them pay their existing and ongoing tax liabilities by allowing them to enter into low-interest payment plans. Employers will still need to meet their ongoing super guarantee obligations for their employees. Sources: Australian government's Economic Response to the Coronavirus , Prime Minister and Treasurer's joint media release, ATO media release and website, 12 March 2020. Payroll Tax In addition the NSW government has announced that it will waive payroll tax for businesses with payrolls up to $10 million for three months. The next round of payroll tax cuts has also been brought forward to raise the threshold limit to $1 million for the 2020-21 financial year. We will keep you well informed and will notify you of any changes. Keep well and remember, we are only a phone call away.